What is Property Tax?

A local government imposes an annual or semiannual fee on the owners of real estate within its jurisdiction, known as a property tax. This tax is calculated based on the assessed value of the property, making it an ad-valorem tax.

Property tax revenues serve as the primary income stream for the majority of local administrations in the United States. These funds are allocated towards supporting educational institutions, law enforcement and firefighting agencies, infrastructure development and maintenance, public libraries, water and sanitation facilities, as well as other essential services that enhance the well-being of the community.

In everyday language, property tax typically pertains to a tax imposed on fixed assets such as buildings or land. Additionally, certain local authorities may also levy taxes on movable assets like vehicles and industrial machinery.

A property tax levy is assigned to different municipalities across states to guarantee the effective and seamless upkeep of civic facilities in different areas, including the maintenance of local roads, drainage systems, cleanliness, and public parks. The state government governs the tax, and its further delegation to various municipalities leads to variations in the criteria for levy, calculation, and the method and manner of payment.

Property that is considered for property tax assessment typically encompasses separate structures such as residential and commercial buildings, as well as flats, apartments, shops, godowns, vacant land, and more. Consequently, owning a property entails its complexities, and comprehending the intricacies of property is crucial for individuals engaging in financial and tax planning.

This article aims to simplify the property tax imposed by the Bengaluru municipality to assist our readers in comprehending and organizing their Bangalore property tax payments more effectively.

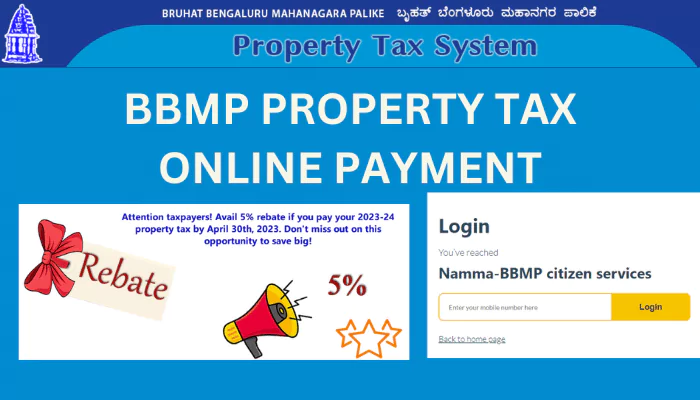

BBMP Property Tax

In Bengaluru, property owners are obligated to pay property tax to the Bruhat Bengaluru Mahanagara Palike (BBMP) annually. The BBMP utilizes these funds to offer civic amenities in the city. To determine the tax amount, the BBMP employs the Unit Area Value (UAV) system, which considers the property’s location and its usage. The UAV is calculated based on the anticipated returns from the property.

The calculation of tax is determined by the fixed per sq. ft. per month (UNIT) based on the property’s location (AREA) and multiplied by the current property tax rate (VALUE). The BBMP’s jurisdiction is divided into six value zones, which are determined by the guidance value published by the Department of Stamps and Registration. The property tax rate varies depending on the zone where the property is situated.

Due Date, How to Pay Property Tax

Taxes play a crucial role in generating revenue for the government, enabling them to finance a wide range of public amenities for the citizens. The government imposes taxes on different aspects, including income tax on earnings and GST on goods and services, among others.

Certain taxes are under the jurisdiction of the central government, while other taxes are specific to each state. The revenues generated from these taxes are allocated to different states to support their respective budgets. Property is an example of a tax imposed by the state government through the local authorities on real estate, including vacant land, on an annual basis.

Also Read a = Top 10 Smart City

GHMC Property Tax

Introduction to GHMC Property Tax

Property tax payment is an essential obligation for property holders, guaranteeing the efficient operation of local government and the advancement of infrastructure. The Greater Hyderabad Municipal Corporation (GHMC) oversees property tax collection in Hyderabad. Familiarizing oneself with GHMC tax regulations, the payment procedure, and methods for accessing tax information is imperative for property owners in the area.

Importance of Paying GHMC Property Tax

The municipal corporation relies heavily on GHMC property tax as its main source of revenue. These funds are allocated towards a range of civic amenities, including the upkeep of roads, waste management, street lighting, and public health services. Neglecting to pay tax can result in legal consequences and penalties, which can have a detrimental impact on property ownership.

How GHMC Property Tax is Calculated

The GHMC calculates property tax by considering factors such as property size, type, location, and usage. The tax rate differs for residential, commercial, and vacant land properties. GHMC officials conduct assessments regularly, and property owners are issued assessment notices containing information about the tax amount.

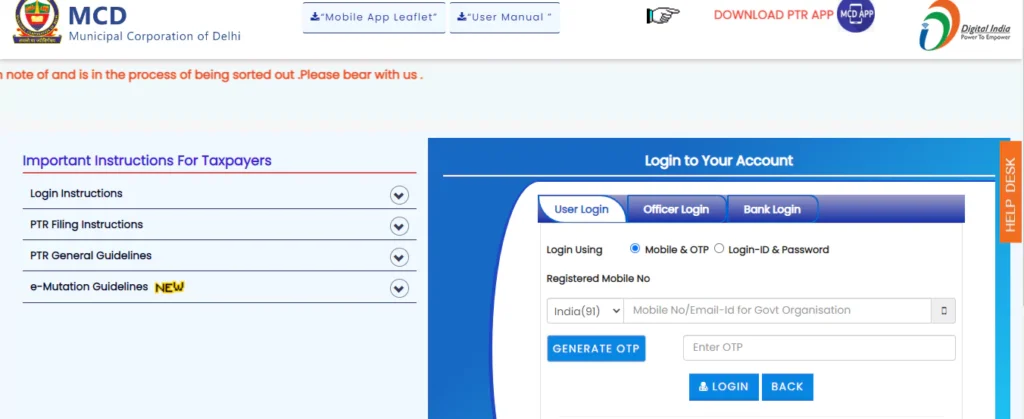

What is MCD Property Tax

Property owners in Delhi are required to remit MCD property tax to the Municipal Corporation of Delhi (MCD) on an annual basis. This tax applies to residential structures, commercial establishments, and undeveloped plots of land. The revenue generated from taxes serves as a significant source of income for the municipal corporation.

Depending on the locality of your property, you will be required to pay property to either the South Delhi Municipal Corporation (SDMC), the North Delhi Municipal Corporation (NDMC), or the East Delhi Municipal Corporation (EDMC). Delhi is segmented into eight categories, ranging from A to H, determined by the property values in the respective colonies.

Also Read = Top 10 Biggest Mall in India

Pay Property Tax Online

Your home is where you create memories with your family, however, it also entails certain obligations. Timely payment of tax is among the various responsibilities that must be fulfilled. Local authorities impose taxes to ensure the provision of vital services like road maintenance, sewage systems, and waste management.

How to Check & Pay Property Tax Online?

Below is a comprehensive manual detailing the steps to verify property tax on the internet and make the payment.

1. You can conveniently access the official website of your local municipal or tax department by conducting a brief online search. This will enable you to locate the specific website of your designated Municipality department.

2. Locate the tax payment section and choose the option for property tax payment.

3. Please furnish the necessary details of your property, such as the bill number, challan number, address, zone, or any other pertinent information, to access the amount of your tax.

4. Please carefully examine all the information provided before proceeding to make a payment through the available payment methods.

5. Upon the successful completion of your payment, a confirmation receipt will be issued to you. This receipt can be printed or downloaded for your future reference.

Please remember that although the process mentioned above is the typical method for paying property taxes, the procedures could differ based on the Municipality.

MCG Property Tax

The Gurgaon property tax, also known as MCG Property Tax, is a direct tax levied by the Municipal Corporation Gurgaon on various types of properties including commercial spaces, residential spaces, rented properties, and vacant lands.

The Municipal Corporation of Gurugram collects the property tax in Gurgaon annually, serving as its primary source of income. The different methods of payment for MCG Gurgaon tax.

Property tax is imposed by MCG similar to other cities, but the rates vary depending on different factors in each city.

The location of the property: If you reside in an upscale neighborhood, you will be required to allocate a higher budget for MCG property tax. Conversely, the charges are comparatively lower for more affordable neighborhoods.

The larger the property’s area, the higher the property tax that must be paid.

The property’s market value plays a crucial role in the calculation of property tax.

Different charges apply to residential, commercial, institutional, and industrial properties based on their respective building types.

The age of the property plays a significant role in determining the amount of tax you will have to pay. In the case of a newly built property, the tax burden will be higher. However, if the property is an old construction, you will enjoy the benefit of paying fewer taxes.

What is PCMC Property Tax

The Pimpri-Chinchwad Municipal Corporation (PCMC) is one of the wealthiest local governing bodies due to the significant presence of multinational manufacturing facilities operating within its jurisdiction.

The region has also become well-known as a real estate hub, with employees working in the manufacturing units choosing to purchase homes in the vicinity. Consequently, several housing developments and residential complexes were established in the area, with infrastructure being facilitated by the PCMC.

Property owners need to pay half-yearly Pimpri Chinchwad property tax (PCMC property tax) to the corporation, which can be easily done online. The PCMC was one of the first civic bodies to collect PCMC tax digitally.

PMC Property Tax

In September 2016, the PMC initiated the process of automating property tax assessments and increasing revenue by implementing geo-tagging of properties within its jurisdiction, as well as identifying unauthorized and illegal properties through the use of Geographic Information System (GIS).

The Pune Municipal Corporation/Pimpri Chinchwad Municipal Corporation has been evaluating properties since 1950 to determine their value and impose taxes based on the property’s location.

The Pune Municipal Corporation (PMC) has employed GIS technology to consistently map approximately 800,000 properties. This proactive approach aims to map a significant number of properties in the coming years. As a result, the PMC can identify defaulters more easily, leading to a remarkable increase in revenue accumulation.

The tax is levied on nearly all properties and vacant lands within the boundaries of the Municipal corporation. The calculation of tax is based on the effective carpet area of the property. The Pune Municipal Corporation utilizes a capital value-based system to calculate tax.

KDMC Property Tax

The Kalyan Dombivli Municipal Corporation (KDMC) serves as the administrative authority for the region of Kalyan Dombivli, situated in the Thane district. Founded in 1982, the KDMC’s central office is based in Kalyan.

The KDMC is entrusted with the task of upkeeping and enhancing the infrastructure and public amenities in the neighboring regions of Kalyan and Dombivli. As per the 2011 census, the KDMC governs an area spanning 67 square kilometers, accommodating a population of 12.46 million individuals.

The twin cities within the jurisdiction of KDMC boast exceptional connectivity to various locations in Mumbai. Approximately 55% of the employed residents residing under KDMC’s authority commute to other cities within the MMR region for work-related reasons.

KDMC Property Tax

You have the option to view and pay your KDMC property tax online through the KDMC website. You can easily access your KDMC property tax bill and make payments either online or offline.

The Kolkata Municipal Corporation (Amendment) Bill was approved on December 15, 2016, to streamline the evaluation and gathering of tax, while enhancing transparency throughout the entire procedure.

The KMC was granted the authority to impose certain restrictions on the rise and fall of tax, thereby granting them the power to regulate it. Additionally, it also facilitated individuals in assessing their tax through a self-assessment system.

Formula KMC Kolkata Property Tax calculation

Annual tax = BUAV x Covered space/Land area x Location MF value x Usage MF value x Age MF value x Structure MF value x Occupancy MF value x Rate of tax (including HB tax)

(Note: HB tax refers to Howrah Bridge tax, which is applicable on properties lying in specific wards.)

Please make sure that your information in the system is current and that there are no pending balances on your account. If you notice any discrepancies, please address them promptly.